About Us

UnitedFinances.com team comprises dedicated experts working together to bring you the best and most reliable financial services on the Internet. Since 2008, our financial and marketing experts backed by our technical department have been working hard to make the loan-taking process as easy and stress-free as possible. Every day, we go through the offers of carefully selected lenders to maintain high standards of service. Those who are up to our standards become incorporated into our database of trustworthy lenders. Once an application is made, we check the terms and rates of every lender and present you only with the best offers.

Our Priorities

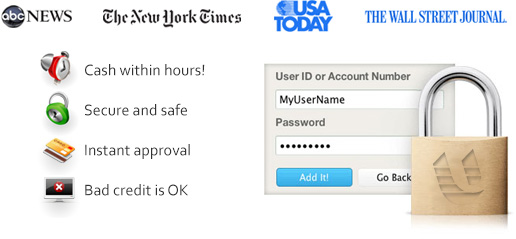

Our goal is to bring you the best loan experience possible - we value your time and your privacy. Our terms are transparent and easy to comprehend, but if you need any clarifying we are always there to help. We always respect your privacy - we use SSL and McAffee to guarantee that your information is safe with us at all times.

The future of online lending

Automation has helped us become one of the most effective lenders in the market. Our lender matching services integrate social search and dynamic search customization, which speed up the loan approval process significantly. Devising our own dynamic search algorithm has allowed us to optimize the entire loan application process for speed, efficiency and accuracy.

How It Works

Dynamic search customization allows our algorithm to crunch all information it can access and make a decision on the spot. Our innovative algorithm analyzes online data in real time, including non-traditional data sources such as social media presence or previous activity with various financial institutions. As a result, customers with good credit get approved instantly, and those with a higher risk profile are contacted for more information. In most cases, no unnecessary paperwork (such as credit reports, bank statements) is required.

Our Commitment

Our aim is to build the biggest marketplace for personal loan products. Once you tell us what you are looking for, we can select the best deal for you and minimize all the hard work you normally have to do. We want to give you the tools and education so that you can start making smarter financial decisions and improve your current financial situation in an instant.

The idea behind UnitedFinances.com

Our company was founded in 2008 by Tom Gorski who wanted to give borrowers a safe place to go to when they needed fast and reliable personal loan products. As our team grew, we realized we all had a common goal in mind - to consolidate our skills and experience from other financial projects in order to build a much better financial project from scratch. From the very beginning, we decided to focus on eliminating all unnecessary elements and simplifying all the necessary ones. We design and craft our offers with the customer in mind, and adding reliable lenders is always high on our priority list. We strive to make our offer as varied as possible, so that all our customers can find solutions to their financial needs.

What is our role in the process?

UnitedFinances.com is not a lender - our aim is to connect you to trustworthy lenders who can compete for your business and give you the best offer available. Contact us 24/7 if you want to avoid the hassle of dealing with banks and credit unions. We’re always there when you need us. How it works It is our belief that applying for a personal should be as easy as possible. Because we don’t want you to feel down or intimidated, we work hard to simplify the whole process so you don’t have to plough through the paperwork and get irritable along the way. Our aim is to connect you only to those lenders who play fair and to keep you away from the judgemental ones.

Here’s how it works:

1.Fill in the instant approval application

Giving us some basic information about yourself and your needs can help us pre-approve you for a loan. The application only takes a few minutes and your data is secure with us.

2. Get matched to a lender who suits your needs best

Once you receive your online approval, you will be redirected to a website where our trusted lenders compete for your business. All lenders we work with adhere to Truth in Lending Act (TILA), which basically means you must be presented with all the terms, fees and lends before you sign any papers. If you don’t like the offer, you can always cancel the process. If chose to selected the terms you have been offered, all you have to do is sign the application and wait for the money to be transferred into your bank account.

3. Accept the terms for cash deposited into your bank account

Once you have signed the contract, the money you requested will be deposited into your bank account. In most cases, you will get the money within an hour or no later than the next business day. This way you can use the money on any unexpected expenses you may be facing.

Rates & Fees

The Internet is full of lenders willing to provide you with the money you need, but how do you know which one to chose? Low interest rates with low associated fees seem to be the best option. However, because we are not a lender, we can’t dictate the loan terms. In other words, the agreement is made only between you and the lender - our role is to connect you only to reputable lenders who adhere to the Truth in Lending Act.

We do our best to verify the lenders, so make sure you do your part - before signing the contract, read the loan terms carefully before you accept them to avoid confusion.

Loan default

You should do your best to pay the money back on the date scheduled by your lender - if you fail to do so, you may be charged with additional fees.

Are there any late-payment fees?

All states have regulations of late-payment fees - it is important for you to understand these before you complete the application process. Check the regulations of your state and talk to the lender if you need to. If you are not certain you can pay the money back on the day it is due, contact you lender in advance and ask if you can be given an extension.

Can everyone get a loan extension?

In some states, getting a loan extension (also called “loan renewal” or “rollover”) is possible. However, if you need an extension, your current interest rates and additional fees are subject to change. Consult your lender and if you come to an agreement, remember to read the loan terms carefully before you sign the new contract.

Do I get charged for the application?

The application process is completely free of charge and does not affect your credit score. Over the years, we have built a database of respectable and reliable lenders who you can turn to whenever you need.