The line that separates a comfortable life and bankruptcy is thin. It only takes a medical emergency or lingering illness to lead one to a life of financial struggle. Everybody knows the story of ‘The Ant and the Grasshopper’, which teaches the value of saving for a rainy day. However, even if the moral of the story is ingrained in our minds from the time we were young, practicing it is a different matter altogether.

But this uncertainty to go through the financial planning process is deeply rooted in misconceptions. The lack of understanding is fueling doubts. A 2016 survey revealed that seven in ten Americans have a phobia of working with financial advisors.

Among their reasons were:

- They feared that they might end up spending a lot of money.

- They were scared of confronting their actual financial affairs.

- They did not trust the financial planning process.

According to the CNBC report, about seven in ten Americans handle their budgets and finances on their own. The figure is alarming, considering that almost eight in ten workers in the United States admit to living paycheck-to-paycheck. And the number of people in this demographic is increasing.

According to the National Financial Educators Council, the lack of financial literacy costs homeowners a great deal of money. A survey of participants across the country found that there were huge monetary losses due to inadequate financial planning.

What Are the Key Steps of Financial Planning?

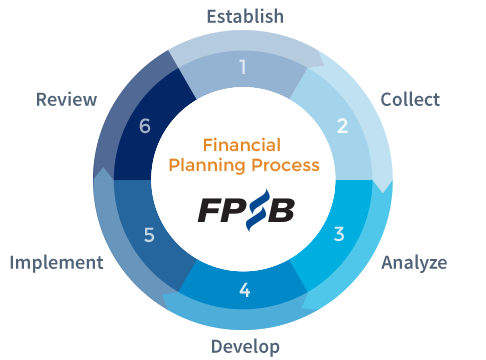

One of the crucial ways to combat fear is by familiarizing yourself with the financial planning process. When you break down the whole procedure into easily digestible pieces, your fear will reduce.

When you work with a financial advisor, you are likely to go through the following procedure:

- Know your financial situation. For most people, this is the most challenging part of the process. When they would have denied their actual financial situation before, they would then move to a position to be ready to confront their fears. It is a matter of how much money you earn and how much expenses you have, including outstanding debts.

- Find ways to stop the bleeding. The next step is to work with your financial advisor to stop the bleeding. From this step, your expenses would be barebones. Anything that is not a necessity would have to be put off. You will then craft your financial goals. Are you saving up for your retirement? Or do you want short-term financial security? What about education for the kids or a contingency fund in case of a medical emergency?

- Determine your options. If the money is not sufficient to support even your household necessities, consider augmenting your income. Can you take another job? Can you consolidate your debts? Do you have equity in your home that you can use for refinancing? Are you as well as your spouse working? And would that be a possibility? Is hiring a babysitter more cost-efficient than one of you being a full-time homemaker?

- Craft an action plan. Planning without action is useless. The action plan should be doable, so you do not get frustrated during the adjustment period. You set the goals by stages to make them easier to implement.

Finally, you need to review your action plan and financial goals regularly. Your circumstances may change in one or two years, which means that your plan may no longer be workable.