Traders do not know how to ply indicators. They jump into trading and desire to become millionaire investors. But, some of the investors are smart. Instead of trading with real money, the investor opens a demo account with the putative broker and tries their utmost to learn the art of trading. In the learning phase, the newcomers become biased with the technical tools. They think these are the best instruments they can find to examine the market dynamics.

However, in reality, indicators are nothing but a bunch of instruments. Traders must use them as a filter or else things will go south quickly. Everybody must know about the stochastic indicator. But do they know the ways of using this like professionals? Let’s know the top 4 uses of this indicator.

Determining the trend

Traders might be thinking that there is no way they can apply the indicator to determine the trend. But if they use this in the hourly time frame, they can easily identify the trend. If they identify a bullish bounce in the stochastic curve after striking the 20 levels, they can anticipate a bullish trend. On the other hand, when the curve floats above the 80 levels, they are going to experience an upward trend. Be very conscious of choosing the time chart. Unless investors use it in a higher time frame, the bounce will be of no applications.

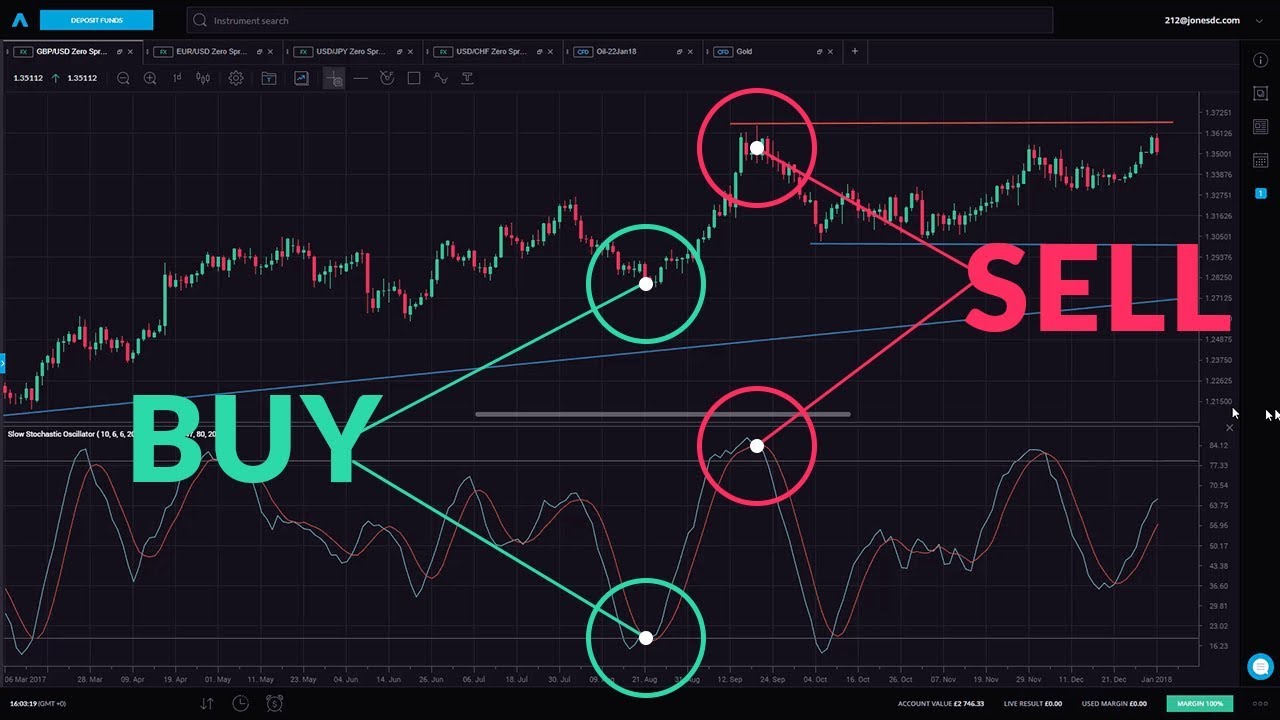

The overbought and oversold phase of the market

The key motive of the stochastic indicator is to search the overbought and oversold phase of the market. If the investor uses the premium platform given by any capital markets, he can easily do so. Here, the best thing about these applications of it that they can be plied in any time frame. The signal line reading the 20 levels refers to the market as in the oversold position. So buying is the only alternative. Similarly, when the signal line strikes the 80 lines, shorting is the best choice for investors.

Being a new Forex trader, you should cautiously use stochastic indicators. It is better to learn its proper functions in the paper trading account. By doing so, you can avoid losing trades in the learning stage.

Apply this with other indicators

By now traders know the two main tasks of the stochastic indicator. However, does the person know can also apply it with other indicators? To do so, they must open the demo account to practice. The best indicator to work with at the side of the stochastic is the moving average. Some of them might get confused about the time of the moving average but they can generally employ the hundred and two hundred SMA. Moving averages are proceeding to provide traders a clear knowledge about the effective support and resistance extent.

Once they find a trade setup at the dynamic band, they can examine the data and try to develop their trading performance. But do not be biased about these instruments, as the investor will still face failure. Be aware of the lot size as this will determine the security of your trading capital.

Adjusting the value of the stochastic indicator

Smart investors can apply the stochastic indicator in different forms. For that, they must adjust the value of the indicators. Though it will be a bit tricky at the primary stage once they learn to adapt to the settings, they can even use it to trade stocks and other assets. Before the investor takes it to the real field, it is needed to back-test his trading approach multiple times. Try to ply this indicator in a higher timeframe so that the investor can offset the mistakes caused by leading outcomes.

The indicator helps make the trading process easy for the investor. You must do be in hurry in terms of using the stochastic. Here, they have to remove the aggression and need to trade with precision.