Over two million installations — that’s the number of solar power systems that are now in use in the US. That’s over 500,000 more installations than the previous year.

In fact, within the last decade, solar has been seeing an average 48% growth rate year by year.

This shows how more people are going green and going solar in the US. After all, it’s more than just a huge cost-saver — it’s also an eco-friendly and renewable choice.

The question now is, how do you get your own system? What are your options when it comes to solar panel financing and purchasing?

We’ll address all these questions (and more) below, so be sure to read on!

A Primer on Why You Want to Go Solar in the First Place

In 2018, the average home in the US consumed 10,972 kilowatt-hours (kWh) of electricity or 914 kWh per month. During that time, the average monthly household electricity bill was $117.65. That’s more than $1,400 a year for electricity alone.

With solar energy, you can save every kWh you use in place of traditional electricity. Even if you were to split their use in half, you can still save over $700 a year. Within 10 years, you can save a staggering $7,000 in savings.

That’s if you use only 50% solar energy. Imagine how much more you can save if you convert your home into a pure solar-energy using abode.

These savings are just the tip of the iceberg, too. Here’s a quick look at some of the other benefits of getting solar panels for your home.

Solar Power Is Clean

The use of fossil fuels for energy produced 37 billion tons of carbon dioxide in 2019 alone. Yes, it’s the same CO2 that makes up a large part of greenhouse gases that contribute to global warming.

Solar power, on the other hand, doesn’t produce these gases, nor does it add to air or water pollution. Manufacturing the panels that make up the systems does have a carbon footprint but at very low rates.

It’s Limitless

So long as the sun is there, you can keep harnessing its power for use at home. Or at least, for the next two decades that your solar panels are still in service.

It Works Even When It’s Cloudy and Gloomy

Cloudy or rainy? Not a big problem. Residential solar panels can still generate 10% to 25% of their normal output during such days.

Shelling Out the Cash for the Cost of Solar Panels

After reading about its benefits, you’re likely wondering why the US isn’t 100% solar yet. Granted, the cost of solar photovoltaic energy has dropped by a staggering 73% from 2010. As more technologies also become available, its price is sure to go down even further.

Still, the solar PV panels themselves are the biggest cost-related issue here. The range varies greatly, but expect a whole-house system to cost between $15,000 to $40,000. That’s still a lot of money that the average US homeowner can’t shell out outright.

Of course, if you do have the budget, then it might be the most cost-effective way to get solar panels. Especially if you qualify for the 26% solar investment tax credit that runs up until this year. If you start construction next year, that credit will drop to 22%.

By paying for your solar panels in one go, you don’t have to worry about monthly payments. You also don’t have to deal with interest payments, which can drive up your costs. Most importantly, you’ll be the system owner right off the bat.

What About Solar Panel Financing Options?

Solar financing programs are usually either secured or unsecured solar loans. They’re much like standard loans, wherein there’s an interest rate applied to the capital.

Let’s take a closer look at both financing methods below.

Secured Solar Loans

Secured solar loans are financing programs that require some form of collateral. In most cases, they place a lien against the property where the installation will take place.

An example is a Home Equity Line of Credit (HELOC) secured solar loan. This makes use of existing equity you have in your home. As a result, you can secure a loan that has a low-interest rate.

Another example is the FHA PowerSaver Home Energy Retrofit Loan Pilot Program. This loan grants up to $25,000 to applicants who wish to make their homes more energy-efficient. These include solar panels, geothermal systems, and even duct sealing.

The Fannie Mae HomeStyle Energy Program can also help you get those solar panels. This loan covers up to 15% of the “as-completed” property value of the improved home. As with the FHA’s PowerSaver loan, this loan also applies to solar panel installations.

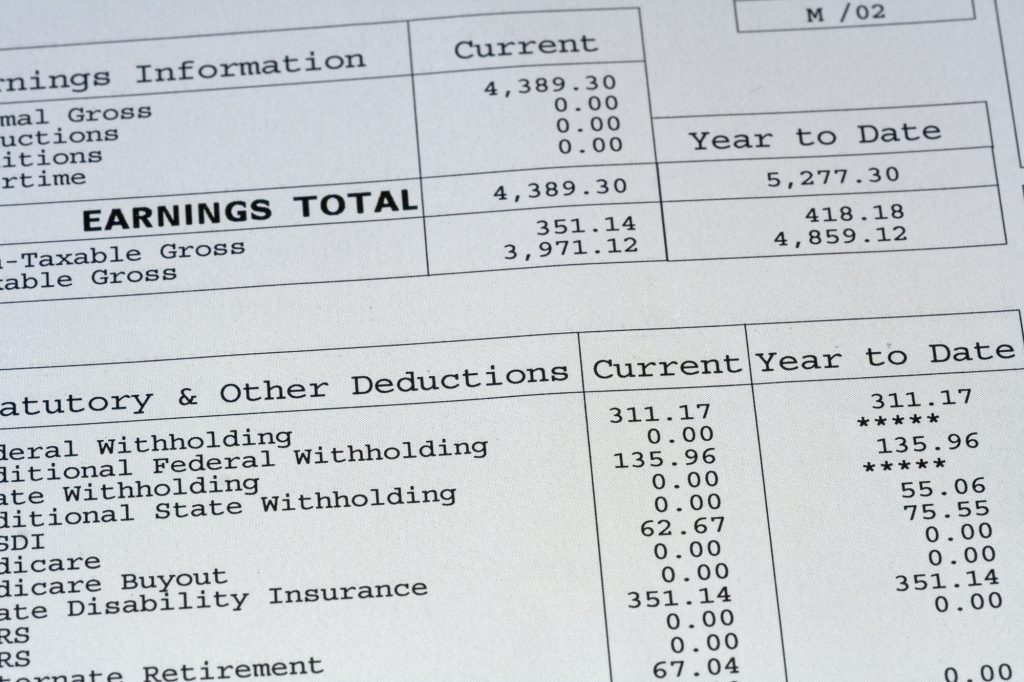

The main drawback of these loans is that they require a good credit score. For instance, the FHA PowerSaver requires at least a credit score of 660, on top of a 45% total debt to income ratio. The credit score rule alone can be hard to meet, especially since 12% of Americans have a score of 550 or lower.

Also, keep in mind that these loans are essentially a lien against your home. Meaning, your home serves as the security for the loan. If you’d wish to sell it at some point, you may be unable to unless you pay back the entire loan.

Unsecured Solar Loans

These are financing programs that don’t require collateral, hence the term “unsecured”. They’re much easier to get than the secured ones, as they also come with fewer requirements. Some lenders, such as Loanpal, also don’t require down payment.

That said, unsecured solar loans do have higher interest rates than secured loans. Again, that’s because they only rely on the borrower’s “promise to pay”. Most unsecured solar loan interest payments are also non-tax-deductible, unlike secured ones.

Still, they may be your better option if you can’t qualify for a secured solar loan. Especially if your issue has to do with a lower credit score. You do want to improve that, but if you wait until next year, you may only qualify for the 22% solar tax rebate.

Speaking of which, you can still get the 26% tax rebate even if you get an unsecured solar loan. By taking out the loan yourself and then using the funds for the installation, you qualify for the rebate.

Leasing Your Solar Panels

Not too keen on buying your own solar panels? Then you may want to consider leasing them instead. With a lease, you can still get the solar panels installed at home, but you won’t be the rightful owner.

The leasing company will retain all ownership rights over the system. Meaning, they’ll be the one to enjoy the 26% tax rebate (if you get them installed this year).

The good thing about leasing is that you won’t have to shell out any money for the panels themselves. The owner will shoulder the costs of the installation, monitoring, upkeep, and repairs.

What you’ll pay for instead is simply the lease fee, usually charged on a monthly basis. With that payment, you can use as much electricity as the panels generate.

Do note that the monthly lease can go up after every year due to the “solar lease escalator”. The biggest contributor here is the cost of maintaining the solar panels. Despite this, your monthly fees will still be lower than your usual electricity bill.

Save up for a Down Payment

Most solar loan providers won’t require you to make a down payment, but you should still consider doing so. This way, you can reduce the total amount of capital that you’ll be taking out. The smaller the loan amount is, the less you’ll have to pay toward interest.

Also, keep in mind that it’ll take less time for you to repay a smaller loan. Moreover, most shorter-term loans come with lower interest rates.

In short, you may be able to completely pay off your solar loan over a shorter amount of time. So, as much as possible, consider saving up for a down payment. Any amount would help make your solar panel installation more affordable.

Get Those Solar Panels Installed With One of These Funding Methods Now

As you can see, there are plenty of solar panel financing options for you to choose from. If you don’t want to pay for the system upfront, a loan is your next best choice. Just make sure to compare as many offers as possible, so you can figure out which one has the lowest interest rates.

Once you have a list of prospective lenders, start sending your applications in! The sooner you get your panels installed, the sooner you can harness the free and limitless power of the sun.

Ready for more tips and tricks that’ll make you more financially-savvy? Then be sure to save this site on your bookmarks bar so you can keep coming back for more posts like this!